monterey county property tax rate 2020

Then question if the amount of the increase is worth the time and effort it will take to appeal. For comparison the median home value in Monterey County is.

Monterey County Schools Coping With Declining Enrollment Monterey Herald

Monterey County Stats for Property Taxes.

. Town of Monterey MA. Normally whole-year property taxes are paid upfront a year in advance. Testing Locations and Information.

074 of home value. For an easier overview of. The property tax rate in the county is 078.

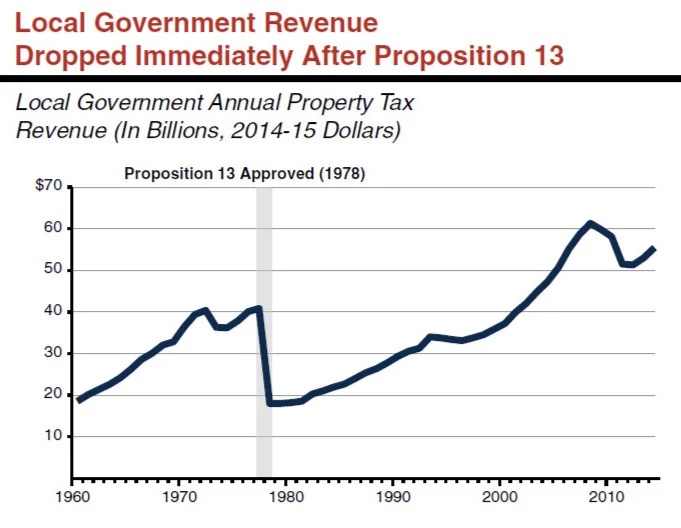

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of. As a result if your home is valued at 1000000 and the. Tax Rate Areas Monterey County 2022.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Single Family Dwelling wGuestGranny Unit and Bath. Tax amount varies by county.

The transfer tax is levied on a portion of the assessed value of a property that exceeds the countys property tax rate. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Real estate ownership shifts from.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the. Choose Option 3 to pay taxes. 2022 Monterey County CA.

Monterey County collects on average 051 of a propertys. As computed a composite tax rate. Website Design by Granicus - Connecting People and Government.

Then who pays property taxes at closing when buying a house in Monterey County. Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. Where Property Taxes Go Monterey County CA from wwwcomontereycaus.

1-831-755-5057 - Monterey County Tax Collectors main telephone number. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. 435 Main Rd PO.

You will need your 12-digit ASMT number found on your tax bill to make payments. Box 308 Monterey MA 01245 Phone. The median property tax in California is 283900 per year for a home worth the median value of 38420000.

The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county.

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts

California Property Tax Calculator Smartasset

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

![]()

Monterey County Property Tax Guide Assessor Collector Records Search More

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

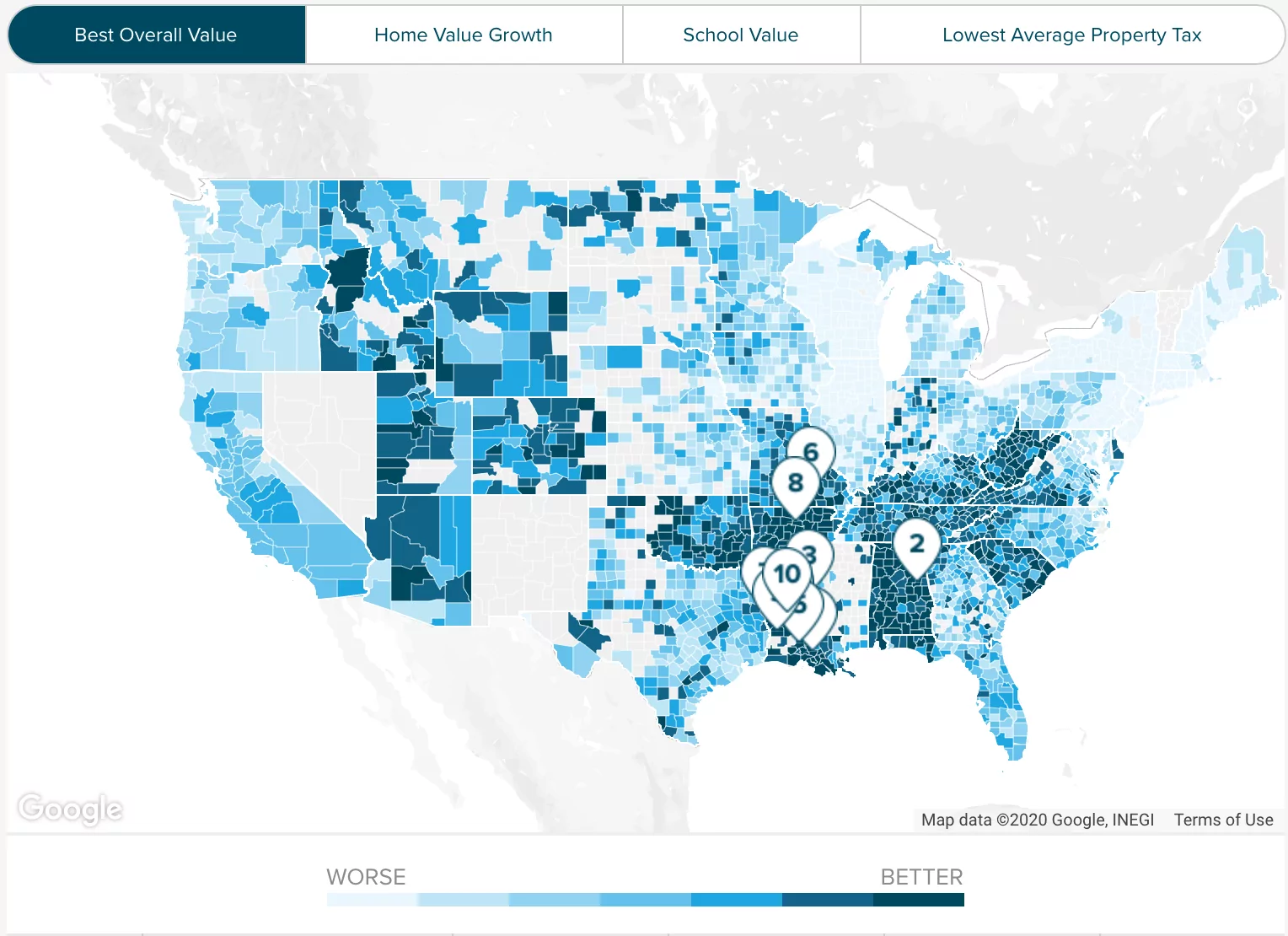

Tennessee Property Taxes By County 2022

Treasurer Tax Collector Monterey County Ca

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

Treasurer Tax Collector Monterey County Ca

Monterey County Board Of Supervisors Accepts Petition For Child Care Ballot Measure Monterey Herald

Alameda County Ca Property Tax Calculator Smartasset

Monterey County Home Prices Market Trends Compass

.jpg)

Local Covid19 Resources United Way Monterey County

Pay Your Property Taxes Treasurer And Tax Collector

Monterey County Property Tax Guide Assessor Collector Records Search More